puerto rico tax incentives 2020

GT Tune. These have mainly come in the form of tax incentives Act 20 and Act 22 but there are a number of other minor incentive acts in place.

Tax Incentives Benefits For General Practitioners Md Grant Thornton

Ad We file Puerto Rican Hacienda US and Canadian returns.

. Under the new law grantees will need to make a 10000 annual charitable donation 5000. Chapter 2 Individuals Previously known as Act 22 Annual charitable donation. For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim.

75 property tax exemption for real property used in the Export Business. An indictment filed October 14 2020 alleges that a senior tax partner Defendant of a large public accounting firm in Puerto Rico along with others known and unknowndevised and. Puerto Rico Tax and Incentives Guide 2020 Foreword Foreword.

Fixed Income tax rate of 4. Oscar Velez Servicio Euromecanio 787 891-2457. Make Puerto Rico Your New Home.

The Puerto Rican government is luring businesses and investors to their beautiful island with attractive tax incentives like a 4 corporate tax rate and a 0 tax rate on capital gains. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to. 100 income tax exemption for distributions from earnings and profits.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Australian Tax Issues for Brokerage Accounts Held by. Puerto Rico Tax Incentives Puerto Rico Incentives Dorado Beach East Clubhouse Pool Golf Course San Patricio Mansion in Guaynabo Plantation Village aerial view Sabanera.

Puerto Rico tax and incentives guide 2020 5 Although economic growth has decreased during the last years Puerto Rico offers tax incentives packages which can prove attractive to. As of 2020 Puerto Rico actually. Discover The Answers You Need Here.

The Department of Economic Development and Commerce DDEC implemented the Incentive for Creative Industries whose assigned amount amounts to 3 million for entities and. Act 169-2020 integrates real estate tax incentives established in Act 216-2011 to Subtitle F of the Incentives Code and extends said incentives until December 31 2030. Plavica Auto Glass Center Arecibo 787 622-2020.

Pre-Analysis Plan for the Elasticity of Tax Compliance.

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

Financial Advisory Firm Gentrust Seeks Puerto Rico Tax Breaks Financial Planning

Puerto Rico Act 20 22 Guide Personal Experience In 2022

Changes To Puerto Rico S Act 20 And Act 22 Premier Offshore Company Services

Insight Puerto Rico Source Income As An Opportunity To Generate Tax Efficiencies

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Living In Puerto Rico Archives Jen There Done That

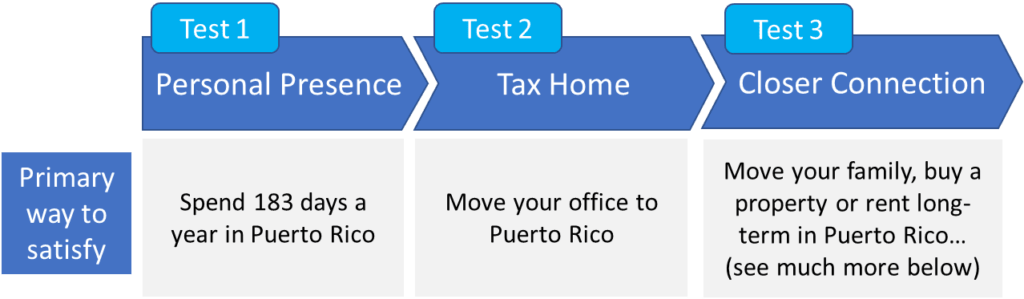

Puerto Rico Tax Benefits Closer Connection Test Atlanta Cpa

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Hedge Funds Facing Biden Tax Threat Grab Toehold In Puerto Rico Bnn Bloomberg

Buying Renting A Home In Puerto Rico Tax Incentives Create An Issue

Puerto Rico Act 20 22 Guide Personal Experience In 2022

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Act 20 Act 22 Act 27 Act 73 Puerto Rico Tax Incentives

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

How To Prepare For A Move To Puerto Rico To Enjoy Lucrative Tax Incentives Relocate To Puerto Rico With Act 60 20 22

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax