tax break refund update

If you havent received. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Here S When You Can Expect Your Indiana Tax Refund Check Wthr Com

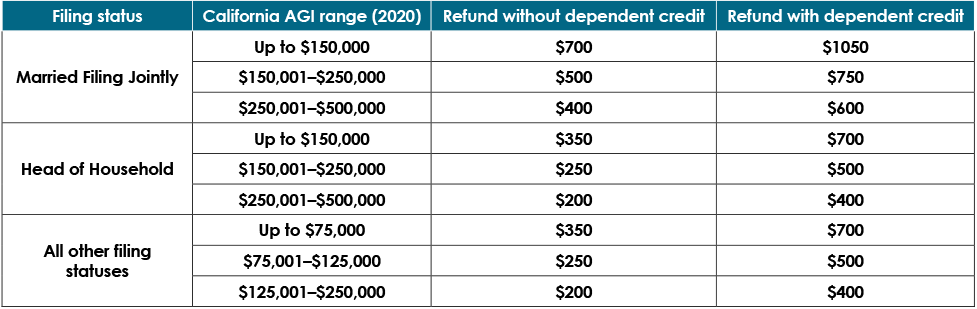

The amount of the refund will vary per person depending on overall.

. Starting in May and into summer the IRS will begin to send tax refunds to those who benefited from the 10200 unemployment tax break for claims in 2020. Eligible taxpayers must file by November 1 2022 to receive the rebate If youre eligible and filed by September 5 we have already issued your rebate. IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. The irs has sent 87 million. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020.

You are expected to get your additional tax refund starting from May. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than. Around 10million people may be getting a payout if they filed their tax.

Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the credit through April 15 2025 by filing a federal tax returneven if they dont normally file and. If you havent filed your 2020. The update says that to date the irs has issued more than 117 million of these special refunds totaling 144 billion.

Using the IRS Wheres My Refund tool Viewing your IRS account. The IRS has started issuing automatic tax refunds to taxpayers who reported unemployment payments before the American Rescue Plan was signed into law in March. Your Social Security number or Individual.

The first refunds will be made in May. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. THE IRS is now sending 10200 refunds to millions of Americans who have paid unemployment taxes.

If youre married filing a joint return your refund will get to you a little bit later than May. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. IR-2021-159 July 28 2021. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on.

Additional New York State Child And Earned Income Tax Payments

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment 10 200 Tax Break Some States Require Amended Returns

Timeline For California Middle Class Tax Refund Payments

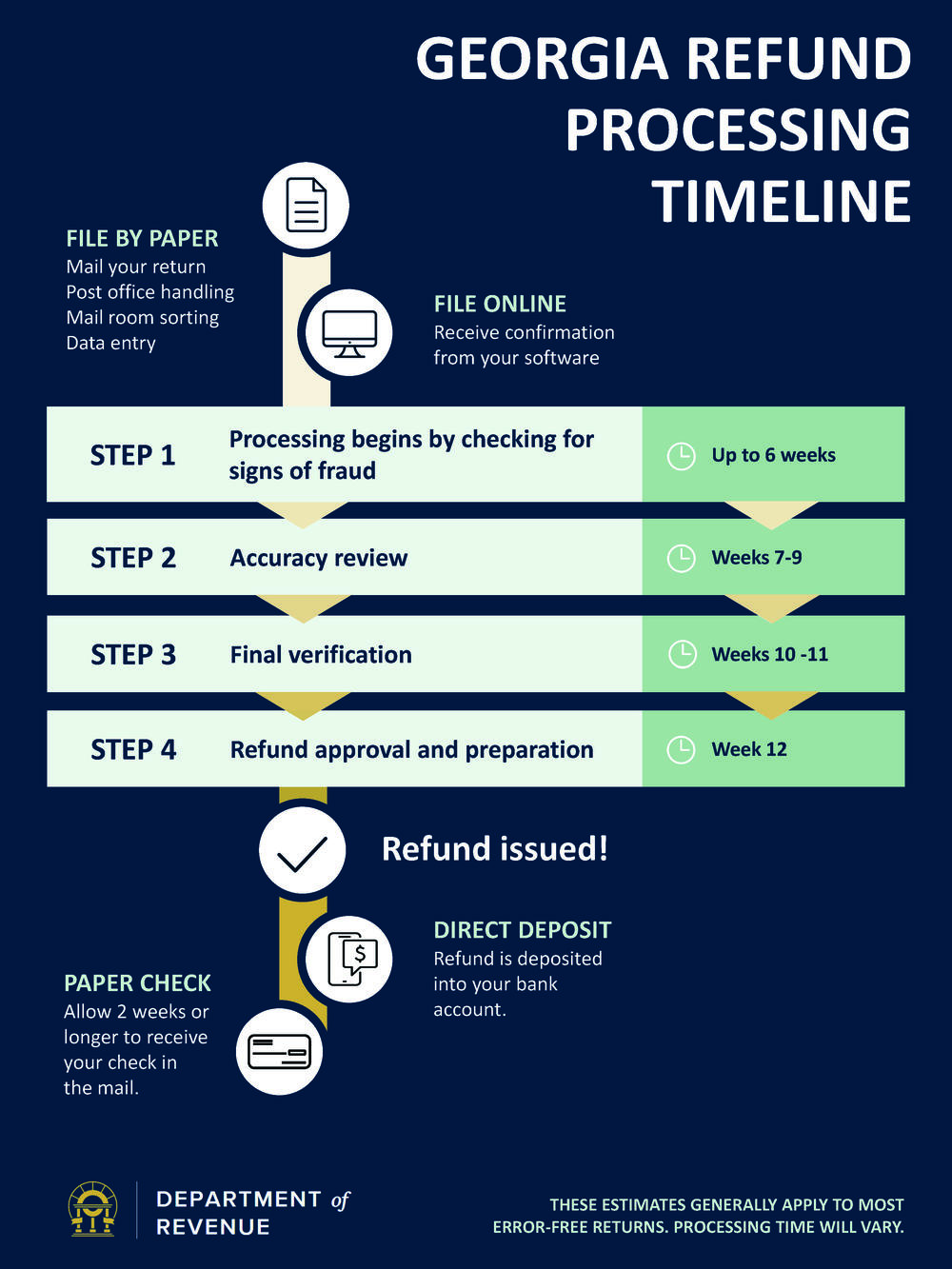

Check My Refund Status Georgia Department Of Revenue

:max_bytes(150000):strip_icc()/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

Irsnews Al Twitter Always Try Https T Co Kcgzug4ksc Resources Before Calling The Irs Https T Co O58xeu35au Https T Co Incgq3x9uq Twitter

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Cash App Taxes 100 Free Tax Filing For Federal State

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

2022 Irs Tax Refund Schedule Direct Deposit Dates 2021 Tax Year

Middle Class Tax Refund Ftb Ca Gov

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds And Relief In The 2022 Ca Budget Deal Grimbleby Coleman Cpas Modesto California

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official